Domestic Financing Trends in Renewable Energy in India

About the Report –

The report titled “Domestic Financing Trends in Renewable Energy in India” will provide a fair idea of various trends in financing renewable energy projects supported by facts and figures of important financial information.

The renewable energy sector has been witnessing significant foreign as well as domestic funding since last couple of years. With ambitious target of 175 GW of renewable energy by 2022, renewable energy sector has approx. 9 lakh crore business opportunities within it.

Solar segment has witnessed a significant growth in last two years i.e. from 3000 MW to 9000 MW by December 2016. This is encouraging huge investment flows in overall renewable sector. The industry has seen many developers seeking FDIs for their renewable energy projects.

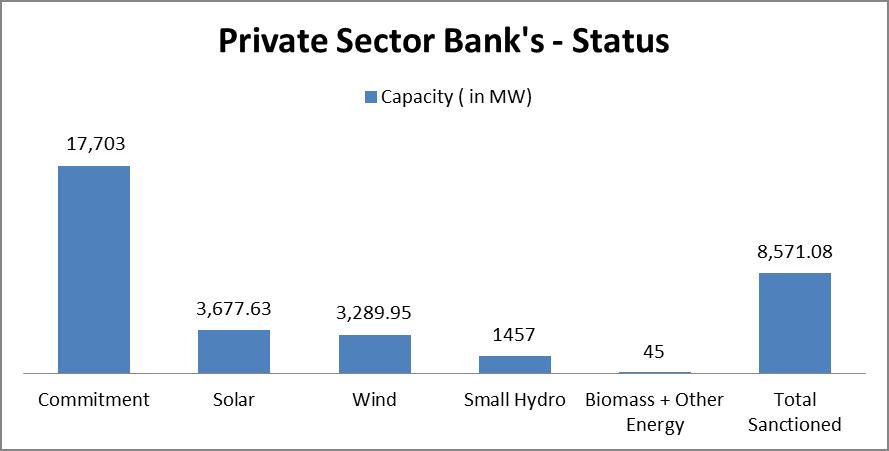

Many Indian Banks and Financial Institutions have also played important role in domestic investment. SBI has financed about 2525 MW of renewable energy projects. YES Bank has financed approximately 3066 MW of renewable energy projects. Both Public and Private NBFC’s have shown their commitment in financing renewable energy projects.

There has been quite a lot of difference in the financing trends segment wise within the RE industry. Where we see the solar sector seeing a major funding, while projects for SHP and other technologies including Biomass doing fair enough in getting finance from domestic banks.

The idea of this report is to highlight the domestic funding in the renewable energy sector. This report presents the details and the quantum of projects sanction by Indian Banks and FI’s.

Who should purchase this report?

• Developers interested in the Indian renewable energy sector

• Venture capital & Private equity firms exploring investments in this domain

• International financial institutions keen on investing in the Indian RE sector

Why You Should Buy This Report?

• There is a lot of inaccurate and inauthentic information available on the internet, in newspapers and various other sources which can skew investor decision-making into renewable energy sector. In this report, the developers will gain access to highly accurate and reliable data

• The report provides the reader critical market intelligence on financing information of various renewable energy projects in India

• This report will help industry consultants and companies align their market-centric strategies

Snapshot of Domestic Renewable Energy Financing

What are the key aspects covered in this report?

This report provides unique insights and critical data points on the following topics:

• Insights of the domestic investment that has happened in the renewable sector in last two years

• Commitments made by various Indian banks and FI’s to finance renewable energy projects

• Segment wise financing status and trend analysis in various renewable energy projects

Buy Domestic Financing Trends in Renewable Energy in India – Report

Avail 15% Discount on the Report until 30th March 2017

Limited Copies Available. Hurry!

The price of the Report is INR 1,200/- plus taxes